Successfully operating a business for the long term requires strategy, goals, vision, qualified professionals, and a lot of money. It is important to review every business expense to maintain the financial health of the business.

In a year, a business spends on a number of goods and services, and these costs are recorded in the income statement (or profit & loss statement) to determine the business’s profitability. But do you know that these costs could help you save money on your tax bill? This is where allowable expenses come in.

Every business expense that falls under the allowable expenses can be deducted from the taxable income of your business. So, let’s find out what allowable expenses mean, how they work, and their examples.

📌 Key Takeaways

- Expenses that solely contribute to business growth can be claimed as allowable expenses.

- An expense must be ordinary, necessary, and wholly used for business purposes to qualify as an allowable expense.

- Supporting documents such as receipts or invoices must be maintained to claim allowable expenses.

- Claiming allowable expenses helps reduce taxable income during tax filing.

What Are Allowable Expenses?

Allowable expenses are the everyday expenses you incur to keep your business running. It can be anything, such as office supplies, professional fees, travel, software, or equipment. All these costs can be deducted from total revenue, which allows you to report lower taxable income.

Tax authorities allow certain expenses if they are necessary to run business operations. However, the expense must meet certain criteria, i.e., “it must be ordinary”, “it must be necessary”, or “it must be wholly and exclusively for business.” If the expense does not meet this criterion, the allowable expense will not apply.

Struggling to Manage Business Expenses Manually?

Let Moon Invoice simplify your expense management. Automate expense tracking and manage them all in one place.

What Criteria Define an “Allowable” Expense?

The U.S. statutory authority, i.e., the IRS, has strict regulations on which expenses are allowable. The following are the criteria a transaction must meet to be reported as an allowable expense:

1. The Expense Must be Ordinary

The expense must be very common and accepted within the industry. Money spent on unique purchases generally doesn’t fall in the “allowable expense” category. The expense should align with the type of your work.

For example, we can say that a construction company’s spending on safety gear is an allowable expense, as it is standard and expected. But, a clothing business leasing a yacht or jet for personal use under the guise of “client entertainment” may not qualify as an allowable expense.

2. The Expense Must be Necessary

Necessary doesn’t mean the business cannot function without it. Instead, an expense is ‘necessary’ if it contributes to smoother operations, efficiency, or growth. An expense without which the continuation or development of business operations is halted is called a “necessary” expense. But in certain cases, it is more than that.

For example, your business may not need a new social media ad campaign. But this campaign, over the next few weeks or months, will boost revenue growth, which meets the criteria.

3. The Expense Must be Entirely for Business

An expense used solely for business purposes can qualify as an “allowable expense.”

Some business owners use mobile phones and vehicles for both business and personal use. In such cases, the portion that is used for personal use can not be claimed as an allowable expense.

For example, let’s say a laptop is strictly used for client projects. It is an allowable expense. Likewise, the fuel cost for a business trip is an allowable expense, whereas the fuel for a family trip is not.

These criteria clearly segregate personal and professional spending.

💡Also Read:

Examples of Allowable Business Expenses

The list of allowable business expenses may vary by industry, but here are some of the most common examples of expenses that qualify as allowable across industries.

| Examples | Descriptions |

|---|---|

| Minor expenses such as paper clips, bindings, and home office expenses (business-use portion only). | |

| Expenses for electricity, water, and phone service are deductible. | |

| Costs associated with social media advertising, brand development, and promotional materials for the business website. | |

| Work-related trips, including accommodation, airfare, and reasonable meal costs while traveling. | |

| Premiums paid for necessary business insurance, such as general liability or equipment insurance. | |

| Expenses for fuel, maintenance, and parking when a vehicle is used for business purposes. | |

| Fees for training, specialized courses, certifications, and workshops aimed at advancing business operations. | |

| Investment in machinery, tools, computers, or other tangible assets required for continuous business operations. | |

| Charges for maintaining business bank accounts, processing customer payments, and currency exchange transactions. |

Allowable Expenses vs Unallowable Expenses

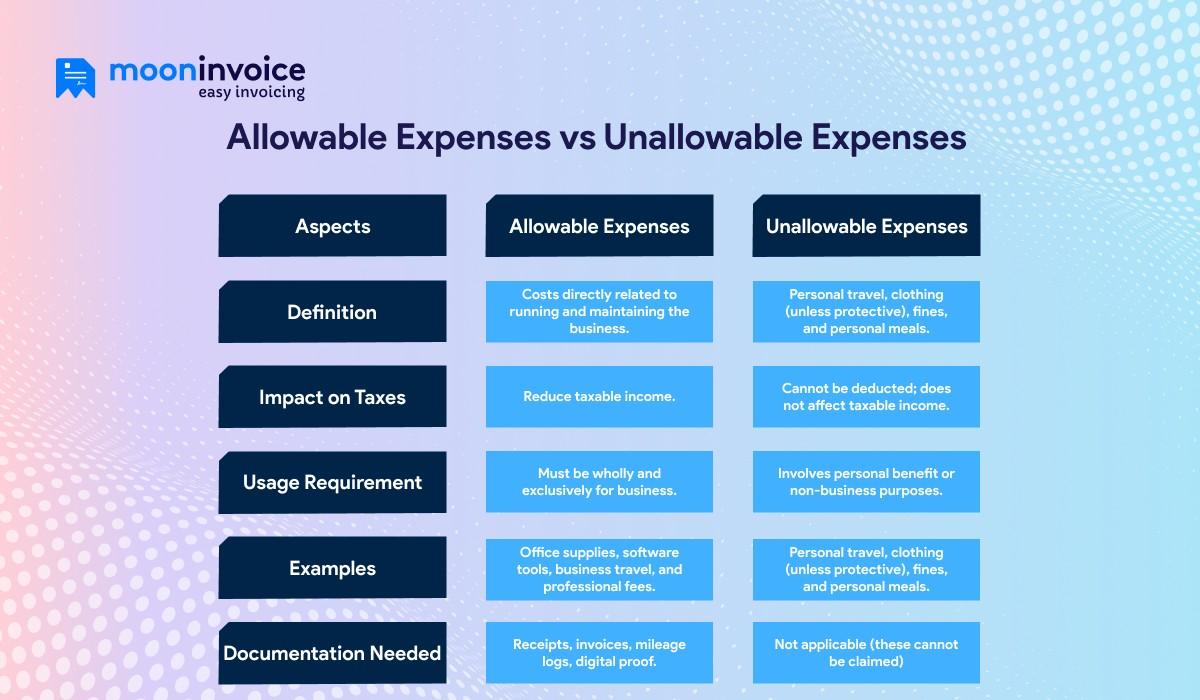

It is obvious that allowable expenses and unallowable expenses are not the same. But what separates them? How to know which one is allowable and which is unallowable? Let’s find out.

Below is a table that clearly separates allowable and unallowable expenses:

| Aspect | Allowable Expenses | Unallowable Expenses |

|---|---|---|

What Are The Key Benefits of Allowable Expenses?

Businesses closely monitor every expense and maintain a record for each. They list the expenses that qualify as allowable. Later, tax authorities evaluate all expenses claimed by the business and confirm which qualify as allowable expenses.

Let’s understand how businesses benefit from allowable expenses in detail with examples.

1. Reduces Taxable Income

Your taxable income immediately reduces once the allowable expenses are applied, as they subtract the actual cost of running your business from your total earnings. The deduction of allowable expenses means you are not paying taxes on your full revenue, but on the profit that remains after deducting these legitimate business expenses.

Example:

Let’s assume your business earns $80,000 in a year and spends $20,000 on allowable expenses such as travel, professional services, and marketing.

Here, your taxable income will be $60,000, not the entire $80,000, as allowable expenses are deductible. You are taxed on the real profit made, not on the costs of running the business.

2. Categorizes Expenses

At the end of the financial year, categorizing allowable expenses is easier when using an automated workflow solution. Any expense you incurred during the year can be categorized separately if it qualifies as an allowable expense.

Example:

Let’s say you are claiming expenses for travel or equipment purchase. Here, the expense will be checked by tax authorities to confirm if it supports your business activities. They also closely look at the amount, which needs to be reasonable and properly documented with invoices, receipts, or bank statements.

3. Provides Clarity During Tax Filing

At the time of filing your tax return, you need to list out all the allowable expenses, including other expenses that were necessary to run your business. You can list out expenses such as software subscriptions, travel costs, client-demanded free samples costs, etc.

Keep in mind, every expense you enter must be supported by either receipts, invoices, or other documents. Later, these expenses are subtracted from your total earnings, which helps you calculate the final profit.

When allowable expenses are claimed during tax filing, it gives a better financial view of your spending and profits. You can see exactly whether you are overspending or cutting too much.

How Moon Invoice Helps You Manage Expenses?

The first step to managing expenses is to log receipts and track them with automation tools. From minor costs to large expenditures, you must maintain proper records of your business expenses.

When the goal is to grow your business, you will constantly face multiple challenges, which is a major reason it becomes difficult to collect documents and keep expenditures organized.

But what if we tell you that you can manage your expenses more easily than ever before? Yes, it is possible when you use software such as Moon Invoice that easily automates expense tracking.

Beyond expense tracking, here are the other key features of Moon Invoice that make it a go-to option:

- Quick Scan/Receipt Scanner: Powered by AI, you can easily scan paper-based expense receipts and convert them into digital documents.

- Professional Invoices: More than 66+ customizable invoice templates to create professional invoices.

- Recurring Expense: Perfect for monthly bills or subscription costs; simply set it once, and the system repeats it automatically.

- Financial Reports: Create financial reports and export them in either PDF or HTML format.

The Bottom Line!

Allowable expenses play a major role in determining the true taxable income of your business. It includes daily business expenses incurred solely for business operations that fuel growth. The primary examples of expenses that qualify as allowable are office utility bills, business travel expenses, business equipment purchases, etc.

So, how do you keep track of your expenses? Are you still following the old-fashioned paper-based processes? It’s time to switch to a digital solution.

Get started with Moon Invoice today and manage your business expenses smartly. Start your free trial now!